Who Pays for Nursing Home If You Have No Money? Find Out!

Navigating the complexities of nursing home care can be overwhelming, especially when finances are tight. If you or a loved one needs this kind of care but worries about the costs, you’re not alone.

Figuring out who foots the bill when funds are scarce is a common concern. This article will guide you through the options available, ensuring you have a clear understanding of how to secure the necessary care without financial stress. You’ll discover the pathways that can provide peace of mind, allowing you to focus on what truly matters—ensuring the best possible care for you or your loved one.

Let’s unravel the mystery of nursing home funding together, so you can make informed decisions with confidence.

Credit: www.bbelderlaw.com

Medicaid Assistance

Medicaid Assistance can be a lifeline for those who can’t afford nursing home care. It provides financial help for long-term care, ensuring individuals receive necessary support without financial stress. Understanding how Medicaid works can ease worries about nursing home expenses.

Eligibility Criteria

Medicaid is for people with limited income and resources. To qualify, individuals must meet specific income limits set by the state. Some assets are exempt, like personal belongings and a primary residence. It’s crucial to understand these limits to determine eligibility. Being aware of the rules helps in preparing necessary documents.

Application Process

The application process involves submitting detailed information about finances. Applicants need to provide proof of income, assets, and medical needs. The process might seem overwhelming, but assistance is available through local Medicaid offices. Having all documents ready can speed up the approval process.

Coverage Details

Medicaid covers various services in nursing homes. This includes room, board, nursing care, and medical expenses. Coverage can vary by state, so it’s important to know local specifics. Understanding what is covered helps in planning for necessary care. Medicaid ensures eligible individuals receive comprehensive support.

Credit: ohionaela.org

Medicare Limitations

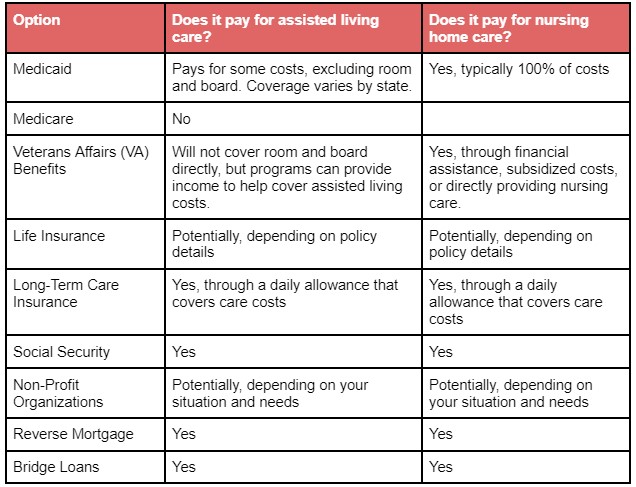

Paying for nursing home care can be challenging without funds. Medicaid often covers costs for those without resources. Eligibility depends on income and assets, offering a safety net for necessary care.

Navigating the financial landscape of nursing home care can be daunting, especially when you have no money. One of the common avenues people consider is Medicare. However, it’s crucial to understand the limitations of this federal health insurance program. While Medicare offers some assistance, its coverage for long-term nursing home care is far from comprehensive.Short-term Coverage

Medicare primarily provides coverage for short-term stays in nursing facilities. This is typically limited to situations where you need skilled nursing or rehabilitation services after a hospital stay. For instance, if you have a hip replacement and require rehabilitation, Medicare might cover up to 100 days in a skilled nursing facility. But what happens on the 101st day? Suddenly, the financial burden shifts entirely to you or your family, leaving many scrambling for alternatives. It’s vital to plan ahead, considering that Medicare won’t cover an extended stay.Exclusions

There are significant exclusions in Medicare’s coverage that you need to be aware of. For example, it does not pay for custodial care, which includes help with daily activities like bathing, dressing, or eating. Many people assume Medicare will take care of all their needs, only to face unexpected expenses. Imagine the stress of realizing too late that help with simple daily tasks isn’t covered. Understanding these exclusions can save you from potential financial strain. Consider other resources or insurance options that cover long-term care. So, what steps will you take to ensure your future care needs are met without financial stress?Veterans Benefits

Medicaid often covers nursing home costs for veterans with limited income. Eligibility depends on financial need and service history. Veteran benefits can also assist with expenses.

Navigating the financial complexities of nursing home care can be daunting, especially if funds are scarce. For veterans, there might be a silver lining. Veterans Benefits offer financial aid specifically tailored to those who have served in the military. These benefits can significantly ease the burden of paying for a nursing home when personal finances fall short. Understanding these options could make all the difference in ensuring you or your loved one receives the necessary care.Aid For Veterans

Veterans and their families might be eligible for various forms of assistance. The U.S. Department of Veterans Affairs (VA) provides programs designed to cover long-term care costs. One such program is the Aid and Attendance benefit, which helps cover the costs of nursing homes for qualified veterans. To illustrate, consider John’s story. A Vietnam War veteran, John was struggling to cover his nursing home expenses. By applying for the Aid and Attendance benefit, he received the financial support he needed, significantly reducing his out-of-pocket costs. This benefit can provide up to $1,881 per month for a veteran, making it a substantial aid in managing nursing home expenses.Qualifying For Support

Eligibility for veterans’ benefits often hinges on service history and financial need. To qualify, you generally need to have served during wartime and meet certain financial criteria. It’s not just about having a service record; your income and asset levels are also considered. It’s crucial to gather all necessary documents, such as discharge papers and financial records, before applying. This preparation can streamline the process and help avoid unnecessary delays. Many veterans find it helpful to consult with a VA-accredited representative to better understand their eligibility and maximize their benefits. Have you considered how such benefits might apply to your situation? Taking the time to explore these options could open doors to much-needed support, ensuring that financial barriers don’t stand in the way of essential care.State Programs

State programs like Medicaid cover nursing home costs for those without money. These programs help ensure necessary care. Eligibility depends on income and assets.

Navigating the financial landscape of nursing home care can be daunting, especially if you’re worried about costs with limited resources. Luckily, state programs are designed to alleviate some of these burdens, providing essential support for those in need. These programs can be a lifeline, helping to ensure that everyone has access to necessary care regardless of their financial situation. By tapping into these resources, you can find a viable path forward without the stress of insurmountable debt.Local Assistance Options

State programs often include local assistance options tailored to the specific needs of your community. Many states offer Medicaid, a federal and state program that provides health coverage to low-income individuals, including nursing home care. You might be surprised to learn that some states also have their own unique programs beyond Medicaid. These can include subsidies, grants, or partnerships with local nursing homes to reduce costs. Consider reaching out to local government offices or non-profit organizations. They can guide you to available resources, ensuring you have all the information you need to make informed decisions. Have you ever wondered how much support might be right at your doorstep?How To Apply

Applying for state programs can seem overwhelming, but breaking it down into steps can make the process manageable. Start by gathering all necessary documents, such as proof of income and identification. Next, contact your state’s Medicaid office or visit their website for application details. They often provide user-friendly guides and forms to assist you. Some individuals find it helpful to speak directly with a representative, especially when dealing with complex questions. Have you considered reaching out for personalized support? It can make a significant difference in understanding your eligibility and ensuring your application is complete. Applying for these programs might seem like a daunting task, but remember, these resources are there to help you. By taking proactive steps, you can secure the support you need for nursing home care without financial stress.Non-profit Support

Non-profit organizations can offer crucial support for those in need of nursing home care without money. These organizations aim to provide financial aid and services to elderly individuals lacking resources. They play a vital role in ensuring that seniors receive the necessary care, despite financial constraints.

Charitable Organizations

Many charitable organizations focus on helping seniors in need of care. They often provide financial assistance for nursing homes. These groups rely on donations and grants to offer support. Some well-known charities include the Salvation Army and Catholic Charities. They may cover part or all of the nursing home costs.

Services Offered

Non-profit organizations often offer various services beyond financial aid. They might provide counseling and advice on navigating healthcare systems. Some offer transportation to medical appointments or help with daily tasks. These services aim to improve the quality of life for seniors. They also ensure that elderly individuals receive the support they need.

Long-term Care Insurance

Paying for nursing home care without money can be challenging. Medicaid often covers costs for those with limited finances. Eligibility depends on income, savings, and assets.

Long-term care insurance can be a lifesaver when you need help paying for a nursing home but lack the funds. This type of insurance is designed to cover the costs associated with long-term care services, which can include nursing homes, assisted living facilities, and even in-home care. It’s a proactive way to ensure you have the necessary support without draining your or your family’s finances.Policy Benefits

When you have long-term care insurance, the benefits vary depending on your policy. These benefits typically cover a portion of the daily costs of care, which can include room and board, nursing services, and personal care. Some policies might also offer coverage for in-home services, which can be a flexible option if you prefer staying in familiar surroundings. Understanding the scope of your benefits is crucial. You should know what percentage of your expenses the policy will cover and for how long these benefits will last. This knowledge helps you plan better and avoid unexpected financial burdens.Claim Process

Filing a claim for long-term care insurance can seem daunting, but it’s manageable with the right steps. First, ensure you meet the policy’s eligibility criteria, which often requires a medical assessment. This assessment determines if you need assistance with daily activities like bathing, dressing, or eating. Once you confirm eligibility, gather all necessary documentation, including medical records and care provider invoices. Submit these documents to your insurance company to initiate the claim process. Stay proactive by following up regularly to check the status of your claim. Your persistence can make a significant difference. Delays in processing can lead to financial stress, but staying engaged keeps the process moving smoothly. Have you considered how long-term care insurance might fit into your financial planning? It’s never too early to think about how you can protect yourself and your loved ones from unexpected expenses.Family Contributions

Facing nursing home costs can be overwhelming. Especially without funds. Families often step in to help. They explore various options. Some families provide direct financial support. Others seek assistance through programs. Understanding each member’s role is key.

Financial Responsibilities

Family members may share costs. Each contributes based on ability. This involves discussing financial capacity. Transparency helps prevent misunderstandings. It’s important to know what everyone can afford. Setting clear expectations is crucial.

Legal Obligations

Legal obligations can arise for families. Some states have filial responsibility laws. These laws demand family support for loved ones. Understanding local regulations is essential. Consulting legal experts can provide clarity. This ensures compliance and peace of mind.

Credit: www.harborlifesettlements.com

Reverse Mortgages

Reverse mortgages can help seniors cover nursing home costs when funds are limited. This financial option allows homeowners to convert home equity into cash, providing much-needed support for long-term care expenses.

When faced with the difficult decision of paying for a nursing home without sufficient funds, many families find themselves looking for creative solutions. One option that often comes up is a reverse mortgage. This financial tool allows homeowners, typically aged 62 or older, to convert part of their home equity into cash. But how does it work, and is it the right choice for you?How It Works

A reverse mortgage allows you to borrow against the equity in your home without having to sell it. Unlike a traditional mortgage, you don’t need to make monthly payments. Instead, the loan is repaid when you sell the home, move out permanently, or pass away. Imagine being able to stay in your home while receiving the financial support needed for nursing home costs. It’s a relief to many who wish to maintain their living standards. However, there are conditions. You must continue to pay property taxes, homeowner’s insurance, and maintain the home.Pros And Cons

Pros: – No Monthly Payments: You won’t have the stress of monthly loan payments. – Stay in Your Home: You can remain in your home for as long as you live. – Flexible Payouts: Choose to receive your funds in a lump sum, monthly payments, or a line of credit. Cons: – Costs and Fees: Reverse mortgages can be expensive, with high upfront costs and interest rates. – Reduced Inheritance: The loan must be repaid when you move out or pass away, which could mean less inheritance for your heirs. – Eligibility and Obligations: You must meet age and home equity requirements and continue to pay taxes and insurance. Is a reverse mortgage the lifeline you’ve been seeking, or does it come with too much baggage? Reflect on your priorities and financial situation. Think of someone who took this path and found it transformative, allowing their family to afford essential care without uprooting their lives. The decision isn’t straightforward, but weighing these factors can guide you toward the best choice for your unique circumstances.Frequently Asked Questions

Can Medicaid Cover Nursing Home Costs?

Medicaid can cover nursing home costs if you meet eligibility requirements. It is a federal-state program assisting low-income individuals. You must demonstrate financial need and meet specific criteria to qualify.

What Happens If You Can’t Afford A Nursing Home?

If you can’t afford a nursing home, there are options available. Medicaid can help if you’re eligible. Some states offer assistance programs for those in financial hardship. It’s crucial to explore all available resources.

Are There Free Nursing Homes Available?

Free nursing homes aren’t typical, but some options exist. Certain non-profit organizations may offer subsidized care. Additionally, Medicaid can help cover costs for those who qualify. It’s essential to research and apply for assistance programs.

Can Family Members Be Liable For Costs?

Family members are usually not liable for nursing home costs. However, some states have filial responsibility laws. These laws may require adult children to support financially dependent parents. It’s important to understand local regulations.

Conclusion

Understanding nursing home payment options eases financial worries. Medicaid often covers costs for eligible individuals. Explore local assistance programs for support. Family contributions can play a role in funding care. Planning early helps secure needed services. Research available resources to make informed decisions.

Contact social services for guidance. Gather documents and apply for aid promptly. Discuss options with loved ones to find solutions. Prepare for future needs by considering insurance. Financial challenges can be managed with proper planning. Stay informed, seek help, and ensure quality care.

Remember, you’re not alone in navigating these decisions.